The Volta Foundation have recently released the 2025 edition of their annual Battery Report. These open-access reports are well-renowned in the battery world and provide a comprehensive analysis of developments in battery research, industry and regulations. We at Mewburn Ellis were delighted to participate in this year’s report, as Mewburn Ellis Senior Associate Chloe Flower co-authored and contributed to the policy section.

In today’s article, which is the third in our series on the 2025 Report and which coincides with National Battery Day (marking the birthday of Alessandro Volta), Chloe explores the steady rise in IP litigation in the batteries field.

Where Are We Now?

The pace of development in battery technologies continues to be impressive, driven by sustained public and private investment, rapid improvements in energy storage performance and growing policy commitments across major markets. While electric vehicle (EV) uptake has not matched the most optimistic forecasts, the sector still represents a critical global growth area, and batteries remain central to industrial strategies from automotive to grid infrastructure.

Against this backdrop, intellectual property (IP) disputes in the battery sector have become more frequent and more visible. Recent litigation highlighted in the Battery Report 2025 spans patents, trade secrets and trade marks across the US, Europe and Asia, reflecting how commercially significant these technologies have become (see pages 750-752 of the report). While the facts of each dispute differ, together they signal a set of broader pressures shaping how companies protect and enforce their IP.

A Changing Commercial Landscape

The global battery market is expanding rapidly, but not uniformly. China continues to dominate large segments of the value chain, from refining and cathode production to cell manufacturing. At the same time, other regions are scaling up: established manufacturers are increasing capacity, new entrants are attracting significant capital, and cross border collaborations – often between automakers and cell suppliers – are becoming more common.

In this increasingly interconnected market, IP has become a critical commercial asset. The disputes referenced in the Battery Report 2025 (from separator technology actions in Europe to trade secret cases in the US and brand protection matters in India) demonstrate how businesses are turning to formal enforcement when seeking to protect their competitive edge.

For companies operating in this space, the key is not simply to track litigation as it arises but to appreciate what is driving this contentious activity. Understanding those forces helps inform portfolio strategy, R&D investment and the terms of future partnerships.

Why Are These Disputes Increasing?

1. Innovation is Rapid, Valuable and Often Convergent

Battery R&D continues at pace, with multiple players working on comparable improvements in materials, chemistry and cell architecture. As technologies converge, even companies acting independently can find themselves occupying similar technical spaces.

This naturally increases the likelihood of disputes. Patents are no longer a passive means of protection; they are active commercial tools. Enforcing them can help shape market positioning, clarify freedom to operate boundaries and secure leverage in licensing discussions.

2. Supply Chain Security Gives Injunctions Significant Power

While battery supply chains are diversifying and regionalising, they remain complex and interdependent. A court order affecting a particular cell variant or material can still have meaningful commercial consequences with downstream effects on automakers and energy storage integrators.

This supply chain sensitivity explains why some disputes escalate quickly and why litigants often pursue urgent remedies: injunctions carry real weight. Even the possibility of disruption can influence how quickly parties move towards settlement or cross‑licensing.

3. Mobility of Technical Talent Fuels Trade Secret Claims

Battery expertise is in high demand, and businesses are aggressively competing for experienced chemists, process engineers and manufacturing specialists. When employees move, questions inevitably arise around the tricky boundary between an individual’s expertise and a company’s proprietary processes, data or manufacturing recipes.

Recent trade-secret disputes highlighted in the Battery Report demonstrate that businesses are taking a more robust approach to protecting confidential know how. Litigation functions not only to address alleged misappropriation but also to signal commitment to protecting confidential assets. It also demonstrates the importance of maintaining well structured internal policies and clear documentation (including contracts and NDAs), particularly when scaling teams or entering joint development projects

4. Global Expansion Is Bringing Brand Protection Disputes to the Fore

As battery companies expand into new regions, brand identity and market recognition matter more. Trade mark and trade dress enforcement is becoming more visible, particularly in markets where consumer awareness of battery brands is rising and competition is fierce.

Such disputes are no longer peripheral; they form part of broader global market entry strategies.

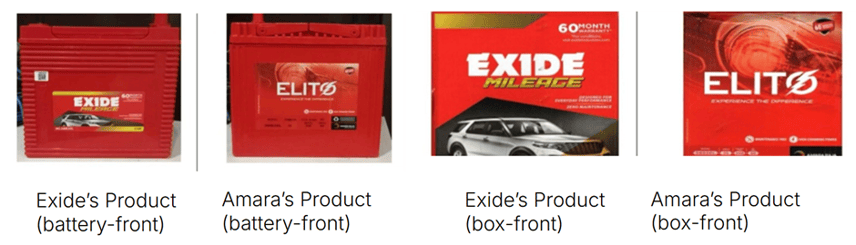

One major example highlighted in the Battery Report is the Exide vs. Amara Raja dispute about Exide’s battery packaging, which was heard in India in 2025. In this case, it was considered whether the combination of certain indicia (‘EL’, the fragmented ‘O’ lettering device, similar size/shape of the batteries and a five-letter mark, along with the use of a distinctive red colour scheme) was a calculated imitation of Exide’s trade dress. The court sided with Exide, granting an injunction against Amara Raja and clarifying the limits of trade mark protection for colour schemes in the industry.

Figure 1: Exide vs Amara Raja (India, 2025) - from page 752 of the Battery Report 2025

5. Litigation Has Become a Strategic Communication Tool

In sectors where IP is a major component of company valuation, litigation can serve several strategic functions:

• signalling technological leadership,

• discouraging competitors from entering certain spaces,

• strengthening negotiating power in cross-licensing discussions, and

• reinforcing investor confidence.

The development of licensing pools in the battery sector reflects a shift towards a more structured, proactive approach to IP management, with litigation playing a central role in defining commercial norms.

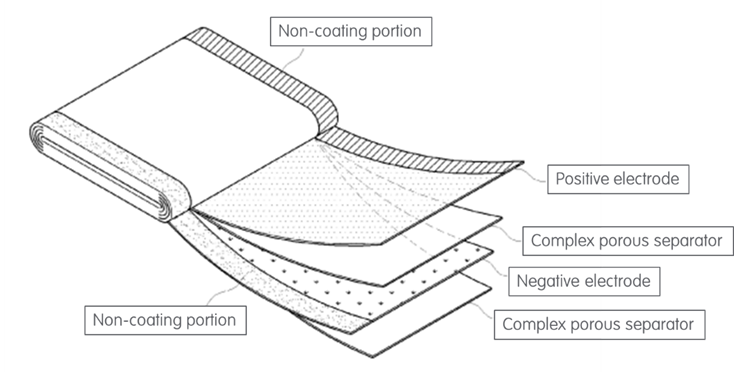

A prominent example of a licensing pool is Tulip Innovation, which provides lithium-ion battery manufacturers with access to a combined portfolio of patents from major industry players LG Energy Solution and Panasonic Energy. Tulip Innovation notably secured landmark injunctions recently in Germany against Sunwoda for infringing three EV battery separator patents, including patent EP 2378595 as shown below:

Figure 2: LG Chemical’s EP2378595, covering a lithium-ion secondary battery with a laminated electrode assembly and a complex porous separator (replicated in the figure), was asserted by licensing pool Tulip Innovation against Sunwoda

The Road Ahead: What this Means for Battery Businesses

With the sector now entering a phase of consolidated growth, companies should expect to:

• Prioritise early IP audits and portfolio mapping

Understanding where your technology sits relative to competitors helps reduce litigation exposure and strengthens your negotiating position.

• Ensure trade secret governance is robust

Clear internal protocols, well drafted employment terms and documented development histories are essential not only for enforcement but also for defending against unfounded allegations.

• Treat collaborations with care

Joint development projects and supply relationships are increasingly common, but they also present risk. Clear definitions of IP ownership and permitted use are essential.

• Monitor competitor filings and enforcement patterns

Litigation is often predictable when viewed against portfolio growth and public enforcement behaviour. Regular monitoring enables proactive, rather than reactive, action.

• Consider brand protection early in international expansion

Trade mark clearance and brand strategy should sit alongside technical IP planning, particularly when entering fast growing or highly competitive jurisdictions.

The rise in IP disputes within the battery sector is a natural consequence of growth, technological convergence and intensifying global competition. While disputes can be commercially and operationally disruptive, they also perform a critical function in shaping a high value, innovation driven industry. For companies navigating this landscape, the key is to anticipate these pressures and ensure their IP strategy is integrated, well structured and aligned with long term objectives.

With a thoughtful, proactive approach, litigation risks can be managed effectively and (in many cases) turned into opportunities to strengthen relationships, negotiate favourable commercial terms and protect the innovations that drive growth.

Read the full Battery Report 2025 series here.

Chloe is an enthusiastic and driven European and UK Patent Attorney who genuinely cares about her clients. Her strong academic background supports her expertise across a spectrum of technologies in the chemistry, materials and medical technology sectors. She brings a unique perspective that bridges advanced materials science with practical engineering challenges - including in cutting-edge medical devices, industrial polymers and next-generation battery systems.

Email: chloe.flower@mewburn.com