The Volta Foundation have just released the 2025 edition of their annual Battery Report. These open-access reports are well-renowned in the battery world and provide a comprehensive analysis of developments in battery research, industry and regulations. We at Mewburn Ellis were delighted to participate in this year’s report, as Senior Associate Chloe Flower co-authored and contributed to the policy section.

Last year, we explored some of the most notable technology trends from the 2024 Battery Report, including advances in electric vehicles beyond cars, stationary storage, sodium ion chemistries, and solid state systems.

We kick off this year’s series by returning to these topics. How have they moved forward over the past twelve months, and what types of technology does this year’s report focus on?

Charged for Take-off

The growth in the use of electric vehicles has been one of the most significant technological developments of the 21st century so far. As battery technologies continue to advance, so too does the breadth of vehicles beyond cars that they can be harnessed to electrify.

This year’s Battery Report shines a spotlight on the accelerating development of eVTOL aircraft – electric vehicles capable of vertical take off, flight and landing. While the concept of eVTOLs has been around for over a decade, interest in eVTOLs, UAS (Unmanned Aircraft Systems) and wider urban air mobility has surged in recent years, driven by advancements in aviation-grade battery technology and increased focus on sustainable aviation.

But challenges remain. To make eVTOLs viable at scale, the report notes that batteries must deliver higher energy density, greater efficiency and longer lifetimes, all while keeping operating costs low (see pages 246-252 of the Battery Report). While the trusty lithium-ion battery offers high power density, its limited energy density (currently ~160-250 Wh/kg) constrains flight duration. Ultimately, range, payload and pack durability will determine whether the sector can take off commercially.

With possible future applications including intra city travel, airport shuttles, emergency medical flights and logistics, the coming years will show whether eVTOLs can move further towards commercialisation.

Storing up Power

Midway through what has been described as the “Decade of Energy Storage”, the implementation of Battery Energy Storage Systems (BESS) continued to rise in 2025.

BESS are large scale rechargeable systems that store energy and release it when required. Their versatility allows for a wide range of applications, from grid connected services such as renewable integration, to off grid uses including remote power supply and backup systems during outages.

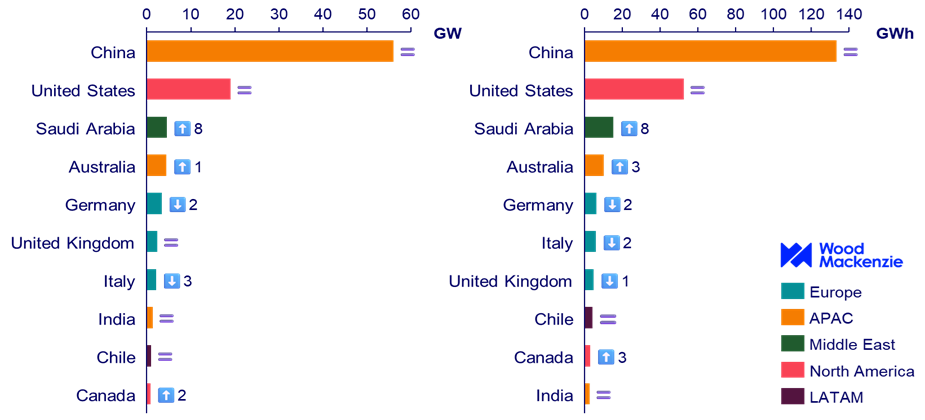

In 2025, new BESS installations totaled 92 GW/247 GWh, bringing global cumulative BESS capacity to 267 GW/610 GWh. Although deployment is rising worldwide, a few regions continue to lead. China maintains their domination, representing over half of global capacity, with North America holding on to second position in terms of energy capacity (MWh). Notably, the report highlights Saudi Arabia and Australia as emerging leaders, each driven by large scale utility projects (see charts below).

BESS Deployed Capacity in 2025 (taken from page 186 of the report, charts provided by Wood Mackenzie)

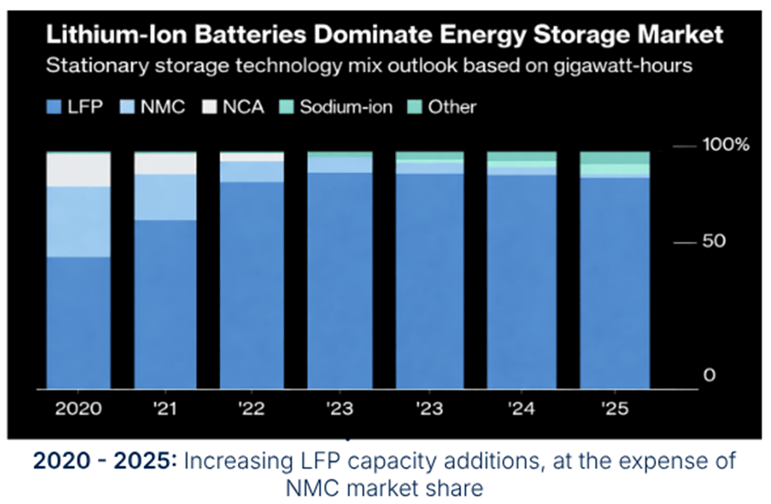

Lithium-ion systems (e.g., LFP, NMC and NCA) remain the dominant technology, accounting for more than 90% of installations (see graph below). However, as reported last year, alternative chemistries like sodium-ion and flow batteries are garnering increased industry attention, especially for longer duration applications.

In particular, sodium ion batteries saw something of a breakthrough year in 2025, especially with NFPP (sodium iron phosphate pyrophosphate) transitioning from R&D into major commercial offerings. Made from abundant, low cost materials and offering promising safety and cost advantages, sodium ion systems are gradually becoming a credible challenger to today’s lithium ion based solutions.

Taken from Page 193 of the report – source: BloombergNEF

Charging Ahead – Minus the Lithium

In sodium-ion technology, China has once again led the early push, driven by its dominant EV industry. CATL announced the Naxtra Battery for EVs, achieving 175 Wh/kg, the highest energy density amongst sodium-ion batteries worldwide and comparable to LFP batteries. With such innovation, it is unsurprising that CATL dominated sodium-ion battery patenting activity in 2025. Away from China, Swedish sodium-ion battery developer Altris announced their investment and collaboration with Volvo cars to explore new battery energy storage systems.

The Battery Report also highlights some other emerging applications of sodium-ion cells beyond grid scale BESS, including lead acid markets, data centre applications, and commercial and industrial (C&I) uses. Lower cost per kWh, improved safety, and strong high rate capability are accelerating broader adoption of sodium-ion technology.

However, it is noted that, for sodium ion cells to reach cost parity with low cost lithium ion chemistries such as LFP, further improvements in energy density and materials efficiency are needed (see page 619 of the Battery Report). Innovation and commercial activity in this space are therefore expected to continue growing.

Solid Progress Toward Commercialisation

Solid state batteries differ from conventional lithium ion cells by using a solid electrolyte to transport lithium ions between the anode and cathode, replacing traditional flammable liquid electrolytes. As discussed in our earlier article on solid-state electrolytes, this technology promises better cell safety and stability, improved high-rate and long-term cell performance, and avoids the need for separators and difficult-to-handle organic solvents. Over time, solid state manufacturing methods also offer the potential for lower production costs.

In last year’s article, we noted that, despite long standing excitement around solid state technology, commercialisation remained some years away. Encouragingly, the 2025 Report indicates that the sector is now “transitioning from breakthrough validation to industrial execution”, with solid state research continuing to dominate academic activity. Recent developments – such as improved energy density, safer electrolyte chemistries, and rapid advances in solid electrolyte materials – suggest accelerating progress toward practical deployment.

From an IP perspective, the 2025 Report shows that patent filings related to solid state lithium ion batteries are heavily concentrated in China. This aligns with the significant presence of major industry players (including WeLion, CATL, and BYD) and the high volume of research output, particularly in lithium metal phosphate systems, emerging from Chinese institutions.

Conclusion

The 2025 Battery Report shows a sector continuing to gain real momentum. Across mobility, storage and next generation chemistries, progress is accelerating and previously emerging technologies are moving closer to commercial reality. As innovation deepens and collaboration across industry and research expands, the future looks increasingly bright – and we look forward to following the breakthroughs that are still to come.

Sophie is a qualified UK and European Patent Attorney specialising in the chemistry and materials science fields. Sophie holds a MSci degree in Natural Sciences from the University of Cambridge. Her final year project involved the synthesis and characterisation of coated nanoparticles for incorporation within a metal organic framework for biomedical applications.

Email: sophie.chua@mewburn.com