Next in our series of blogs, we have investigated the major players in the SEP landscape in Europe.

The dataset is that discussed, encompassing all applications filed at the EPO between 1993 and 2021 where they have been classified into the H04 IPC category. From that, we distinguish between those applications which have been declared to ETSI as standards essential (“ETSI”) and those that have not (“Not-ESTI”).

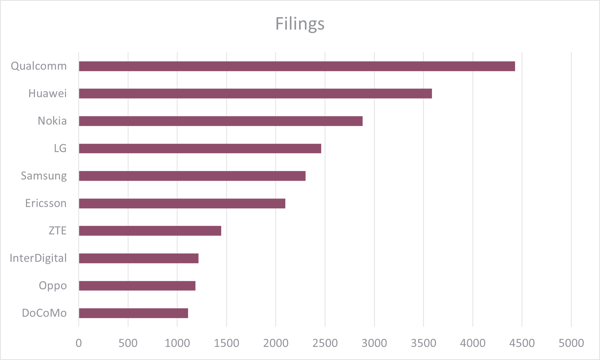

To begin with, we identified the top filers in H04 where the application or patent was declared to ETSI:

The results are in line with our expectations given the market, with Qualcomm, Nokia, and Huawei leading the pack.

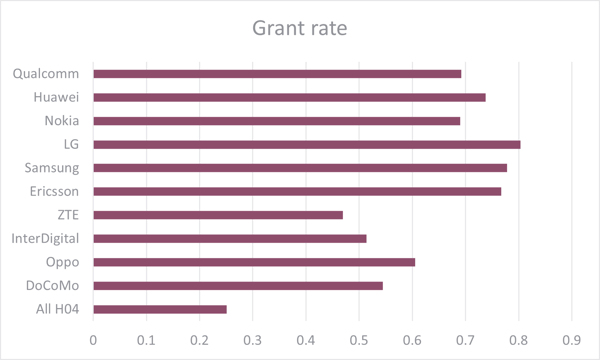

Digging further, we’ve also looked at the relative grant rates of each of these applicants (total number of ETSI grants / total number of ETSI filings):

Interestingly, whilst all the applicants have a significantly better than average grant rate (as compared to all of the applications in H04), there also some significant variation within the applicants. LG has the highest grant rate, with 80% of their SEP filings resulting in a grant. Whereas companies like ZTE and InterDigital have significantly lower grant rates, 47% and 51% respectively.

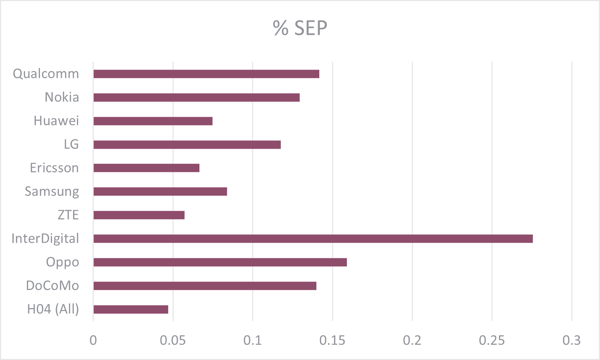

The data also allowed us to examine the filings in the context of the applicant’s business model. The plot below shows the % of all of an applicant’s H04 filings which had subsequently been declared to ETSI as standards essential:

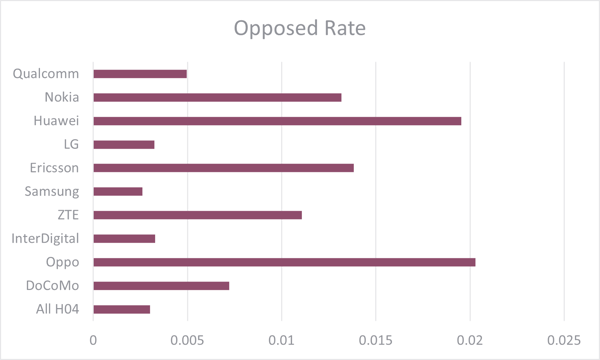

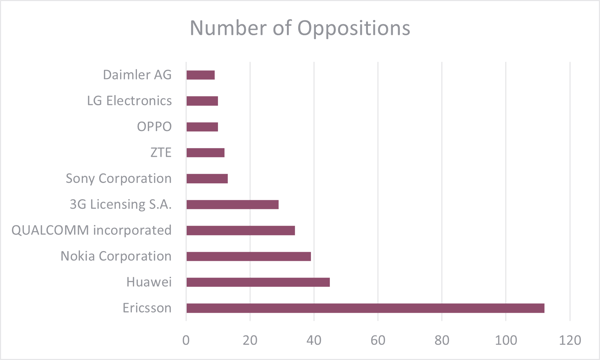

Finally, we also looked at contentious matters, firstly by considering who received the most oppositions to their granted patent and then, conversely, looking at who filed the most offensive oppositions within this space:

It’s worth noting some additional players entering the mix here, including Daimler AG, 3G Licensing S.A, and Sony.

Please get in touch if you have a question that you think our data can answer!

Tom is a Partner and Patent Attorney at Mewburn Ellis. He handles a wide range of patent work, including original drafting, prosecution and opposition, particularly defensive oppositions, in the engineering, electronics, computing and physics fields. Tom also advises on Freedom-to-Operate, infringement issues and registered designs.

Email: tom.furnival@mewburn.com

.png)