The world of cryptocurrency is a fast-moving and complex one. Cryptocurrencies such as Bitcoin have been recognised and confirmed by law as a species of property1 but with the more recent addition of digital assets in the form of Non-Fungible Tokens (NFTs) to the digital landscape, we are now seeing further layers of complexity. The difficulty with NFTs stems from their nature and their similarities and connection with and to real-world property. NFTs are essentially a digital reflection of real-world assets but they are so new that the legal world is still working on how the laws that apply to real-world assets, should apply to NFTs and the digital transactions and interactions surrounding them.

While the concept of cryptocurrencies has been around since the 1980’s, the release of the Bitcoin software to the public in 20092 launched the worldwide cryptocurrency movement. NFTs on the other hand, are a much more recent development and the establishment of the NFT marketplace can be traced back only as far as 20203. Arguably, the March 2021 sale of the NFT of Beeple’s digital artwork, “Everydays: the first 5000 days” for $69.3m by the auction house Christie’s4 that arguably brought NFTs to the attention of the public.

The celebrity (or notoriety) gained by NFTs in the last couple of years inevitably means they have been the subject of a few cases before the courts, though, as we mentioned, the application of the law to NFTs is very much in its infancy. The most significant of these cases (Lavinia Deborah Osbourne v (1) Persons Unknown (2) Ozone Networks Inc. trading as Opensea [2022] EWHC 1021 (Comm) 10 March 20225) considered the crucial question of whether an NFT can amount to legal property. We will consider this case in detail, but first some high-level background on NFTs.

What is an NFT?

An NFT is a unique (“non-fungible”), indivisible “token” that has been “minted” (created) on a blockchain. They are essentially a digital construct or “vehicle” for the reference object – the actual asset the NFT represents. These assets are generally artworks or digital music or video files.

In contrast, cryptocurrencies like Bitcoin are both fungible and divisible. This means they can be exchanged for one another like physical currency (one 20p piece is the equivalent of another 20p piece) and can be broken down into units as long as the value remains the same (like two 10p pieces or four 5p pieces).

The key components which make up an NFT “vehicle” are:

Smart Contract

This sets out the:

- digital artwork, video, photograph or music file that the NFT represents, the “Referenced Object”

- actual digital object or a hyperlink to the object

- transaction – if condition A (payment) is met, then consequence B occurs (transfer)

The Chamber of Digital Commerce, the world's largest trade association representing the digital asset and blockchain industry, defines a smart contract as a “computer code that, upon the occurrence of a specified condition or conditions, is capable of running automatically according to prespecified functions. The code can be stored and processed on a distributed ledger and would write any resulting change into the distributed ledger."

TokenID and Contract Address

These are both identifiers relating to the NFT. The TokenID is a unique alphanumeric sequence which refers to the specific NFT whereas the Contract Address refers to where the contract is deployed on the blockchain (such as Ethereum) and include information such as the NFT’s transfer history, number of NFT holders in the collection etc.

Owner or Wallet address

this the address of the owner of the NFT, it is essentially a software-generated purse that you use to ‘hold’ and store NFTs.

How do you make one?

Anyone can create (mint) an NFT from a digital object such as an artwork, a video, music file or a photograph. All you need to do is connect your digital wallet to an NFT marketplace and upload the digital file that you want to mint your NFT from. The basic procedure is very simple but the questions about ownership and entitlement are more complex. While you might own the NFT you’ve minted, this doesn’t mean that you own the intellectual property (IP) in the underlying object.

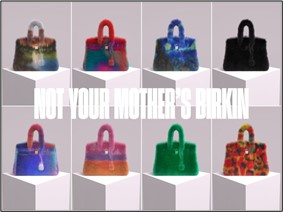

One of the most well-known cases on NFTs which illustrates this very point is Hermès International v Mason Rothschild U.S. District Court of Southern District of New York 22 CV 384 (JSR). In [November 2021], Mason Rothschild minted a series of 100 NFTs called “MetaBirkins”. These were all digitally generated images of the famous Hermès Birkin handbags. Rothschild “re-imagined” the bags wrapped in various fur coverings, including one inspired by Vincent Van Gogh’s “Starry Night”.

Fig 1. Published by Fashion Law Business Author – Joseph Barber and Tania Phipps-Rufus

https://www.fashionlawbusiness.com/flbstories/the-outcome-of-hermes-lawsuit-against-metabirkin-nft-may-provide-a-glimpse-into-the-future-of-fashion-and-art-in-the-metaverse

In addition to the NFTs, Rothschild also registered and used the domain www.metabirkin.com and social media account handles including @MetaBirkins (Twitter) and @MetaBirkins (Instagram). Hermès International objected to Rothschild’s activities and field a claim for; infringement of their Birkin marks, dilution of the same and cybersquatting. In May this year, the court denied Rothschild’s application to dismiss the claims so watch this space as the case is ongoing.

Are NFTs “property”?

Disputes over ownership and entitlement to IP have long been the subject of litigation so when it comes to use and infringement of the IP in NFT reference objects, the position seems likely to be a natural extension of these well-established principles. However, on top of this, the courts now also face an entirely new question, - putting the underlying reference object aside, does the NFT amount to an item of legal property in its own right?

Judge Pelling KC considered this very question in his internationally significant, landmark High Court decision earlier this year, Lavinia Deborah Osbourne v (1) Persons Unknown & Anor [2022] EWHC 1021.

Lavinia Deborah Osbourne, the claimant in this case, is a fintech and blockchain specialist and the founder of the popular and successful “Women in Blockchain Talks” podcast6.

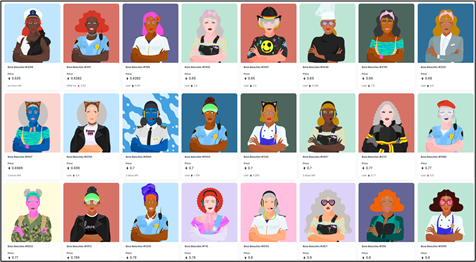

Osbourne owns two NFTs which represented digital artworks from the Boss Beauties series (the value attributed to them by the court was £4k but it was understood that they were of “particular, personal and unique value to the claimant”). The NFTs were stolen from Osbourne by being removed without permission from her MetaMask digital wallet and later reappearing, attributed to wallets belonging to unknown individuals.

Fig 2. Screenshots of the Boss Beauties series of NFTs available on OpenSea

https://opensea.io/collection/bossbeauties

In filing these proceedings with the court, Osbourne sought (and was granted) applications for:

- An interim injunction to freeze the 2 stolen NFTs (preventing any further transfers).

- An order under the Bankers Trust jurisdiction which would require OpenSea to provide information enable the identification and tracing of the wallets and their owners.

Decisions to grant freezing and proprietary injunctions regarding stolen cryptocurrency have been issued before7 but this is the first instance of a court issuing a freezing injunction in respect of NFTs as a distinct class of cryptoasset. The court identified NFTs as being distinct from cryptocurrencies due to their non-fungible and indivisible nature.

Judge Pelling QC stated:

“There is clearly going to be an issue at some stage as to whether non-fungible tokens constitute property for the purposes of the law of England and Wales, but I am satisfied on the basis of the submissions made on behalf of the claimant that there is at least a realistically arguable case that such tokens are to be treated as property as a matter of English law.”

While this is an undeniably trailblazing decision, the groundwork in regarding digital assets as legal property had already been established by earlier cryptocurrency cases so it was not an entirely unexpected outcome, especially considering the growing recognition of the importance of digital assets to the economy.

As an indication of this importance and also of the relative vacuum that the legal profession is currently operating in respect of these assets, the Law Commission of England and Wales Cases published a consultation paper in July 20228. The paper sets out various law reform proposals regarding the recognition and protection of digital assets. The consultation paper is open to responses until 4 November 20229.

We await the outcome of the consultation with great interest and expectation.

References

- AA v Persons Unknown [2019] EWHC 3556 (Comm) https://caselaw.nationalarchives.gov.uk/ewhc/comm/2019/3556, Director of Public Prosecutions v Briedis & Anor [2021] EWHC 3155 (Admin) https://www.bailii.org/ew/cases/EWHC/Admin/2021/3155.html

- https://www.forbes.com/sites/bernardmarr/2017/12/06/a-short-history-of-bitcoin-and-crypto-currency-everyone-should-read/?sh=7a5aab93f279

- https://ipkitten.blogspot.com/2022/09/guest-post-cant-be-evil-nft-license.html

- https://www.christies.com/features/Monumental-collage-by-Beeple-is-first-purely-digital-artwork-NFT-to-come-to-auction-11510-7.aspx

- https://caselaw.nationalarchives.gov.uk/ewhc/comm/2022/1021

- https://womeninblockchaintalks.libsyn.com/

- Ion Science Ltd v Persons Unknown (unreported, 21 December 2020, Commercial Court)

- Full paper: https://s3-eu-west-2.amazonaws.com/lawcom-prod-storage-11jsxou24uy7q/uploads/2022/07/Digital-Assets-Consultation-Paper-Law-Commission-1.pdf

Summary: https://s3-eu-west-2.amazonaws.com/lawcom-prod-storage-11jsxou24uy7q/uploads/2022/07/Digital-Assets-Summary-Paper-Law-Commission-1.pdf - https://consult.justice.gov.uk/law-commission/digital-assets-consultation/

Emma is a lawyer for the Legal and Trade Mark Practice Groups and is responsible for producing, managing and maintaining the bank of know-how, precedents and other materials and resources. In addition, she delivers regular training, updates and articles for the Practice Groups, the firm and its clients, covering developments in the law and in practice. Emma has a BSc in Biology from the University of York and obtained a Graduate Diploma in Law from the University of Law, York. She completed a training contract in the Leeds office of a top regional law firm, qualifying as a solicitor in 2013.

-1.png)